washington state long-term care payroll tax opt out

1 2021 opt-out deadline. The WA Cares Fund.

Long Term Care Act Fife Milton Edgewood Chamber Of Commerce

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply.

. Deadline to opt-out of long-term care payroll taxes extended Contact. To opt-out the employee must provide identification verifying their age and apply for ESD exemption between October 1 2021 and December 31 2021. One man I spoke with recently.

The most significant legislative change is additional time for employees to opt out of the public program. Near-retirees earn partial benefits for each year they work. If you want to opt out of a payroll tax that begins in January assessed to fund a state-run one-size-fits-all long-term-care-insurance fund that you might or might not benefit from read more about the coming tax on our Center for Health Care blog here is what we know.

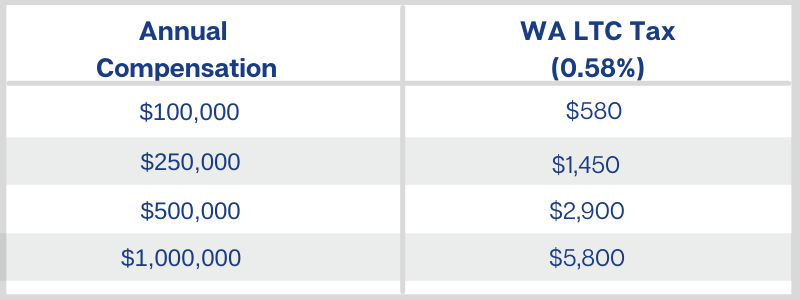

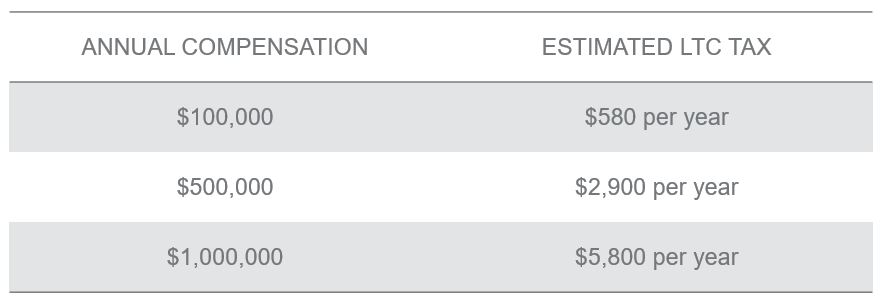

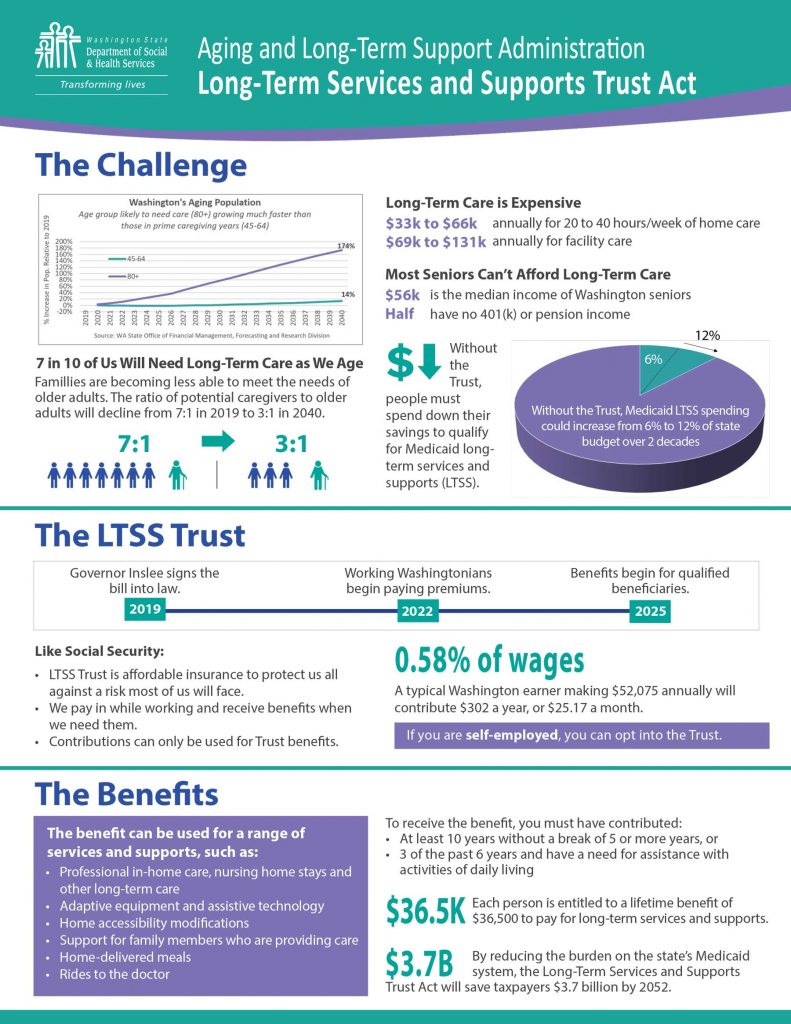

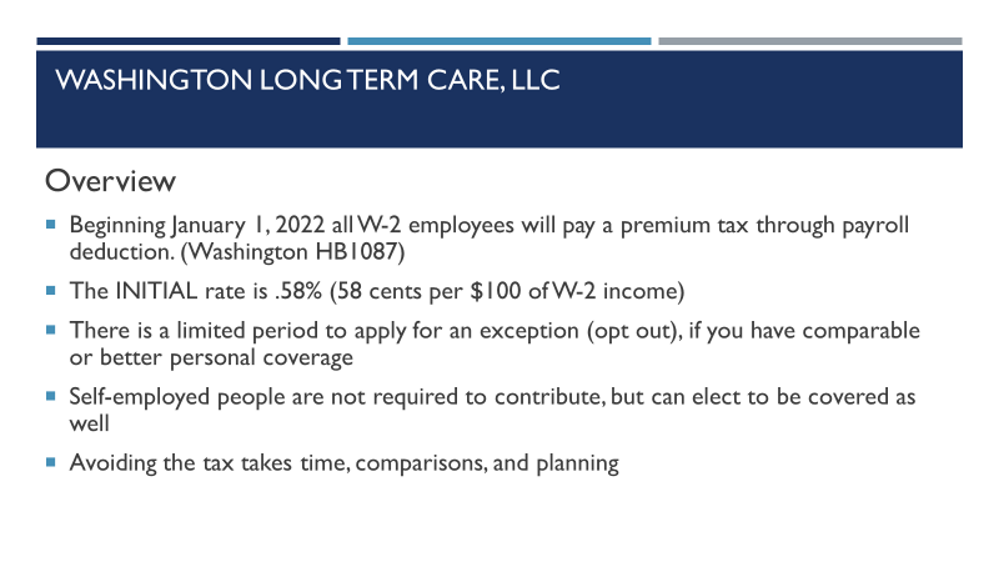

You need to already have or purchase a long-term-care plan through a private insurer by. February 4 2022 On January 27 2022 Governor Jay Inslee signed two bills that delay implementation of the Washington Cares Act to July 1 2023 including the 058 payroll tax and provide additional exemptions from the program. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire.

Candice Bock Matt Doumit A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and its associated payroll taxes is on its way to the Governor. Workers who live out of state can opt out. November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy.

New State Employee Payroll Tax Law for Long-Term Care Benefits. Veterans with 70 disability can opt out. The new tax is for a mandatory long-term-care program called the WA Cares Fund.

Starting January 1 2022 a 058 premium assessment will be imposed on all Washington employee wages. The initial premium rate 058. This new fund was created by the State Legislature to.

Before we outline the process lets review some details about the new WA Cares Fund. They reluctantly allowed a single opt-out choice that expires Nov. 1 day agoWorkers could get an exemption if they had private long-term care insurance and thousands of people scrambled for that coverage before the.

1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent. The regressive tax is 58 cents per 100 earned with no income limit. However an employee has a one-time opportunity to opt-out if they have comparable private long-term care insurance see below for details.

WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington. Washingtons first-in-the-nation law creating long-term care benefits for residents who pay into a state fund wont start payroll deductions until 2023 after a retooling this year according to. SEATTLE Starting Oct.

Many of the states employers quickly offered workers the opportunity to buy private plans. The benefit which has a lifetime limit of 36500 would have made a big difference during. Due to the overwhelming demand for LTC insurance in Washington policies likely will no longer be issued in time to meet the states November 1 2021 deadline.

The State of Washington has now opened their online opt-out procedure for those who have qualifying Long-Term Care Insurance and wish to be exempt from the upcoming payroll tax. As of January 2022 WA Cares Fund has a new timeline and improved coverage. You must purchase your own policy prior to November 1 2021 to opt out of this payroll tax.

By Marc Glickman FSA CLTC This article first appeared in CLTC Digest Spring 2021. Workers on non-immigrant visas can opt out. She hoped it would be a resource for others facing similar challenges.

Washington was prepared to roll out this program at the beginning of the year but the new bills have delayed the timeline by 18 months. 1 residents can apply to opt out of the WA Cares Fund a new long-term care insurance benefit for workers in Washington state. 2 days agoChristina Keys 53 was thrilled three years ago when Washington state passed a first-in-the-nation law that created a long-term care benefit for residents who paid into a state fund.

2 days agoWorkers could get an exemption if they had private long-term care insurance and thousands of people scrambled for that coverage before the Nov. Opting back in is not an option provided in current law. Recent changes to Washington State law will require employees to acquire long-term care insurance by November 1 2021 to avoid additional payroll taxes.

The program which will be funded by a. The date has arrived. In 2019 Democrats in Olympia passed a hefty new payroll tax that will hit paychecks starting in January.

Military spouses can opt out. Turns out they were a bit premature. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program.

Get a Free Quote What is the Washtington State long term care tax. There are no specific exemptions for hospital or health system employees. 1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit.

Can You Opt Out Of State S New Long Term Care Act And Tax Should You

Washington State Long Term Care Payroll Tax Steadfast Insurance

Washington State Long Term Care Act Update Parker Smith Feek Business Insurance Employee Benefits Surety

Washington State Long Term Care Tax What You Need To Know North Town Insurance

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Ltca Long Term Care Trust Act Worth The Cost

Washington State Long Term Care Tax Here S How To Opt Out

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 11 Bogleheads Org

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 8 Bogleheads Org

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Despite Reports Washington S Long Term Care Tax Could Start Jan 1

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

Payroll Washington Long Term Care Llc

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management