oregon statewide transit tax filing

Self-employment transit tax e-filing. Oregon employers must withhold 01 0001 from each employees gross.

Navigating The New Oregon Transit Tax Delap

OAR Division 320 Provisions Applicable to Privilege Tax.

. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018.

Check the box for the quarter in which the. Office use only Page 1 of 1 150-101. Click the Payroll Info tab.

01 Date received. 05-24-21 o R--1 o Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Withholding Return Instructions General information The new statewide transit. This tax will be strictly enforced and employers could face.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Oregon Department of Revenue 2021 Form OR-STI Oregon Statewide Transit Individual Tax Return Submit original formdo not submit photocopy. If you have an extension to file your personal income tax return check.

6-25-20 Orego eae of Revee o R-- o Form OR-STT-A Oregon Annual Statewide Transit Tax Withholding Return Instructions General information Employers. Oregon tax filing and payment deadline from April 15 2020 to July 15 2020. Page 1 of 1 150-206-001-1 Rev.

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Oregon Statewide Transit Tax Forms O R-STT1 STT2 and STTA Beginning with returns filed in January 2021 there will be a new bulk-filing method available for this tax program. Oregon Transit Payroll Taxes for Employers Following are the 2022 district transit.

The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018. Lets run a Payroll. Personal income tax rates and tables.

The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates. Oregon Statewide Transit Individual Tax. This tax will be strictly enforced and employers could face.

That are not subject to this tax. When the due date for filing. Go to the Employees menu and select Employee Center.

Double-click on the employee name. Page 1 of 1 150-206-003-1 Rev. As a result interest and penalties with respect to the Oregon tax filings and payments extended by this Order will.

Let me walk you through the steps. Rule 150-320-0520 Statewide Transit Tax. Reporting and Payment Due Dates.

Employers that expect their statewide transit tax liability to be less than 50 per year may request to file and pay the tax annually instead of quarterly. 01 Date received. File and pay the tax due by April 18 2022.

Check the box for the quarter in which the.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

2019 Tax Information Form W 2 Wage And Tax Statement Form 1099

Oregon Employment Dept Says Modernized Computer System On Track To Launch In Fall Ktvz

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

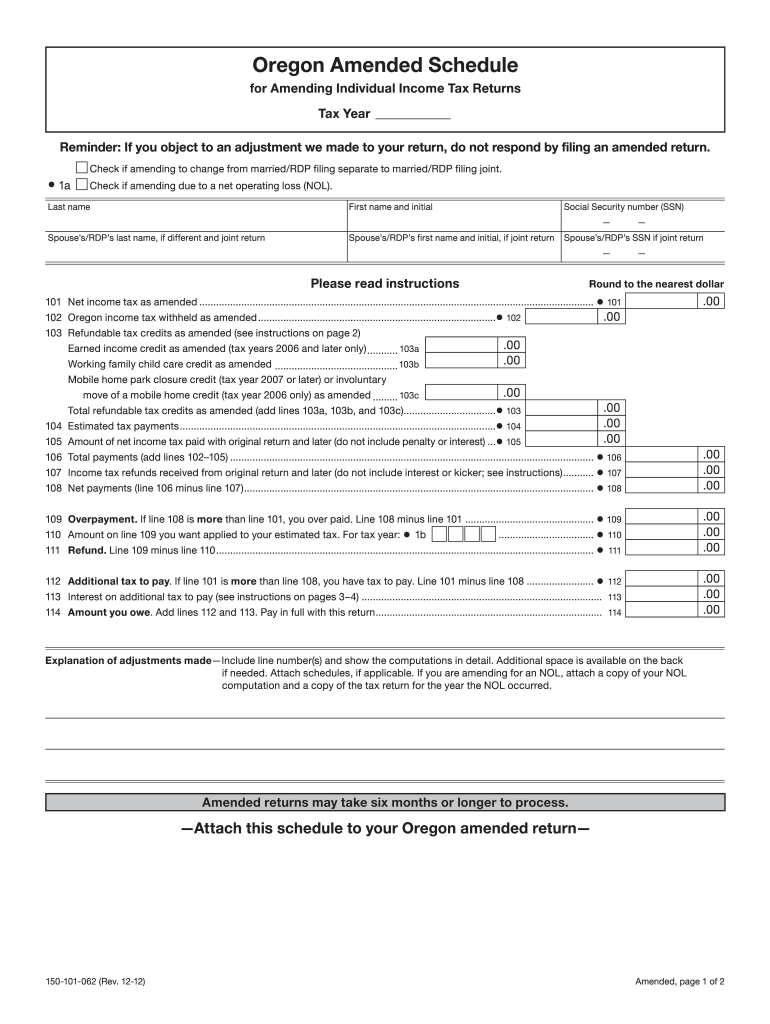

Oregon Amended Schedule 2012 Form Fill Out Sign Online Dochub

Oregon S New Transit Tax Confounded Turbotax Fouling Up Returns Oregonlive Com

Oregon S New Statewide Transit Tax Southland Data Processing

Ezpaycheck How To Handle Oregon Statewide Transit Tax

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

Or Kicker Surplus Credit Drake21

What Is The Oregon Transit Tax Statewide Local

How To Hire Employees In Oregon

April 2021 Oregon Office Of Economic Analysis

Oregon Form Or Wr Annual Withholding Tax Reconciliation Report Cfs Tax Software Inc

Sales Taxes In The United States Wikipedia

A Refresher Transferring Your Oregon Transit Tax Information From Sage 100 To The State

4 New Oregon Taxes Take Effect In 2018 Kval

Oregon Labor Laws The Complete Guide For 2022

Can I Import The Form Oq Oregon Quarterly For A Single Bin In Oprs Oregon Employment Department